Non-Corrugated Boxes Market Size, Competitive Analysis and Trade Data

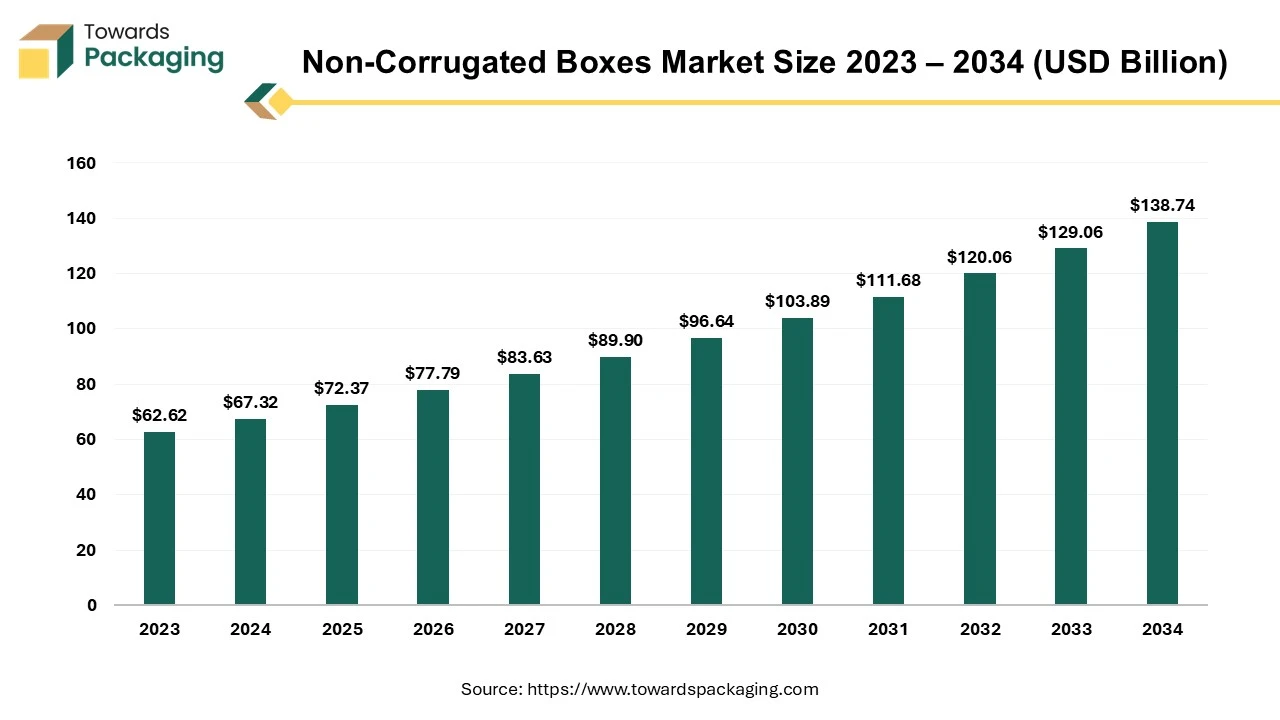

According to researchers from Towards Packaging, the global non-corrugated boxes market, estimated at USD 72.37 billion in 2025, is forecast to expand to USD 138.74 billion by 2034, growing at a CAGR of 7.5% over the forecast period.

Ottawa, Oct. 10, 2025 (GLOBE NEWSWIRE) -- The global non-corrugated boxes market was assessed at USD 72.37 billion in 2025, with projections indicating an increase to USD 138.74 billion by 2034, based on insights from Towards Packaging, a sister firm of Precedence Research.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Asia Pacific leads the market due to its strong manufacturing base, growing e-commerce sector, and expanding consumer goods industry. The region’s rising preference for eco-friendly and customizable packaging options further supports market expansion. Moreover, technological advancements in packaging materials and printing enhance product appeal and brand visibility across diverse applications.

Non-Corrugated Boxes Market Leading Manufacturers Shares, 2024 (Global)

Scope & method: Non-corrugated boxes are primarily folding cartons & set-up (rigid) boxes. Exact global company shares are not publicly reported, so the figures below are reasonable estimates derived by mapping each company’s 2024 net sales that are predominantly folding-carton packaging to the 2024 global folding-cartons market size.

Estimated global market shares, 2024

| Rank | Manufacturer (global) | 2024 share (%) | |

| 1 | Graphic Packaging International (GPI) | 5.00 | % |

| 2 | WestRock – Consumer Packaging | 2.40 | % |

| 3 | Mayr-Melnhof (MM) – Packaging divisions | 1.40 | % |

| - | All other manufacturers (highly fragmented long tail) | 91.20 | % |

Manufacturer explanations (what’s behind each share)

-

Graphic Packaging International (GPI) - ~5.0%

- Among the world’s largest pure-play folding-carton converters across food, beverage (notably multipack cartons), and household categories.

- 2024 net sales of USD 8.807B were largely from consumer paperboard packaging, which closely aligns with non-corrugated boxes.

-

WestRock - Consumer Packaging - ~2.4%

- WestRock’s consumer-packaging arm covers folding cartons, beverage carriers, and coated paperboard converting.

- Q1 FY24 consumer-packaging sales were USD 1.06B; extrapolated to the full year (and cross-checked with subsequent quarters) places the segment a little above ~USD 4B in 2024.

-

Mayr-Melnhof (MM) - Packaging - ~1.4%

- MM is a leading global folding-carton producer with two packaging divisions (Food & Premium; Pharma & Healthcare).

- 2024 group sales = EUR 4,079.6M; with Packaging ≈ 57% of mix, packaging revenue is ~EUR 2.33B (≈ USD 2.5B), translating to ~1.4% global share.

-

All other manufacturers - ~91.2% (fragmented long tail)

- Thousands of regional converters (Asia-Pacific, Europe, North America) produce folding cartons and set-up boxes for food, pharma, cosmetics, and electronics.

- The category is highly localized with many niche specialists and private players; hence the sizable combined share of “Others.”

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5230

What Are the Latest Trends in the Non-Corrugated Boxes Market?

-

Sustainability & Eco-friendly Materials

Growing environmental awareness and regulatory push are making recyclable, biodegradable, or recycled paperboard and plastic materials much more popular. Manufacturers are increasingly using materials that align with circular economy goals.

-

E-Commerce Expansion

As more consumers shop online, demand rises for packaging that is both protective and enhances presentation. Non-corrugated boxes (folding cartons, rigid boxes, etc.) are used for secondary/retail packaging and unboxing experiences.

-

Premiumization & Aesthetic Appeal

Brands are using non-corrugated boxes to differentiate themselves. High-quality print finishes, embossing, coatings, special textures, etc., are gaining prominence. Visual appeal matters more in retail display and online product presentation.

-

Technological Innovation in Manufacturing

This includes better printing techniques, die-cutting, use of AI for optimizing designs (waste reduction), and integrating smart features like QR codes or NFC for engagement or tracking.

-

Regulatory & Policy Support

Governments in many countries are imposing stricter packaging / plastic-use regulations, promoting sustainable solutions, and offering incentives/subsidies. These support adoptions of non-corrugated, eco materials.

-

Cost Pressure and Efficiency

Although non-corrugated boxes generally cost less in material compared to high-grade corrugated, efficiency in production, reduced transportation cost (lighter weight), optimizing sizes, etc., are critical. Businesses aim to lower production, storage, and shipping costs.

- Smarter / Digital Print & Finishing: There is a high demand for more elaborate finishing (spot UV, foiling, embossing) and custom, limited-edition packaging for branding.

- Smart / Connected Packaging: The use of QR codes and NFC tags is rising to provide information or enhance consumer engagement.

- Lightweighting: Using thinner paperboard materials without compromising strength, to reduce material use and shipping weight. This helps both cost and the environmental footprint.

- Customization & Small Batch Production: Brands (especially in premium / luxury / niche sectors) want tailored box designs rather than mass uniform standard boxes. This includes smaller print runs but higher design complexity.

What Potentiates the Growth of the Non-Corrugated Boxes Market?

Non-corrugated boxes are gaining traction largely due to increasing regulatory pressure for sustainable packaging, growth of e-commerce, cost optimization, and premium branding needs. Governments in many regions are introducing stricter laws around plastic use and waste, pushing companies to switch to recyclable and biodegradable materials. At the same time, online retail is driving demand for boxes that are protective in transit yet lightweight. Companies also aim to cut production and shipping costs by using lighter materials or optimizing designs. Additionally, consumer comfort with premium packaging that enhances product presentation and brand image fuels demand.

For instance:

- Domtar’s Kingsport Mill has developed 100% recycled containerboard that is lighter but maintains the strength of virgin-fiber board, enabling the use of 5-7% less fiber while meeting performance requirements.

- Metsä Board promotes “lightweighting” of its paperboard, reducing material use and environmental impact while preserving strength and quality.

- Mondi Group has been upgrading plants (e.g., in Warsaw) and acquiring other operations to expand sustainable production capacity and deliver innovative, lighter packaging solutions.

Limitations & Challenges in the Non-Corrugated Boxes Market

Recycling Challenges

The non-corrugated boxes market faces restrictions due to limited durability, fluctuating raw material costs, recycling challenges, competition from corrugated packaging, and high production investments, all of which reduce adoption in developing regions. Many non-corrugated boxes are made from mixed materials, such as coated paperboard or plastic laminates, which are difficult to process in standard recycling facilities. This leads to lower recycling rates and contributes to environmental concerns, making them less attractive to both consumers and businesses focused on sustainability.

More Insights of Towards Packaging:

- Plastic Packaging Market Leads USD 636.64 Bn at 4.4% CAGR - The plastic packaging market is projected to expand from USD 432.11 billion in 2024 to USD 636.64 billion by 2034.

- Flexible Packaging Market Size Driven at USD 488.72 Bn by 2034 - The flexible packaging market is expected to see growth from USD 308.74 billion in 2024 to USD 488.72 billion by 2034.

- Industrial Bulk Packaging Market 2025 Driven by 3.25% CAGR – The global industrial bulk packaging market is projected to reach USD 37.86 billion by 2034, expanding from USD 28.39 billion in 2025, at an annual growth rate of 3.25% during the forecast period from 2025 to 2034.

- North America Packaging Market Driven by 4.33% CAGR - The North America packaging market is forecasted to expand from USD 333.86 billion in 2025 to USD 488.92 billion by 2034, growing at a CAGR of 4.33% from 2025 to 2034.

- Connected Packaging Market Size, Trends, Consumer Engagement, and Technological Advancements - The connected packaging market is anticipated to grow from USD 50.41 billion in 2025 to USD 83.02 billion by 2034.

- Bulk Container Packaging Market Size - The bulk container packaging market is anticipated to grow from USD 4.87 billion in 2025 to USD 11.21 billion by 2034.

- Pharmaceutical Contract Packaging Market Growth, Trends, and Regional Insights - The global pharmaceutical contract packaging market is projected to increase from USD 17.06 billion in 2024 to approximately USD 43.46 billion by 2034.

- Polyethylene Films Market Growth Drivers - The polyethylene films market is expected to grow from USD 100.73 billion in 2025 to USD 149.69 billion by 2034, with a CAGR of 4.5%.

- Confectionery Packaging Market Size - The global confectionery packaging market is projected to grow from USD 11.04 billion in 2024 to USD 15.73 billion by 2034.

- Biopharmaceuticals Packaging Market Outlook Scenario Planning - The biopharmaceuticals packaging market is set to grow from USD 23.01 billion in 2025 to USD 49.98 billion by 2034, at a 9% CAGR.

- Carton Packaging Market Key Trends - The carton packaging market is expected to increase from USD 213.03 billion in 2025 to USD 353.84 billion by 2034, growing at a CAGR of 5.8%.

- Global Packaging Market Size, Share, Trends & 3.16% CAGR - The global packaging market size reached US$ 1.24 trillion in 2024 and is projected to hit around US$ 1.69 trillion by 2034.

- Refillable Packaging Market Key Players - The Refillable Packaging Market is expected to grow from USD 46.59 billion in 2025 to USD 64.25 billion by 2034, with a CAGR of 4.1%.

- Consumer Packaged Goods (CPG) Market Segmentation - This report explores the global Consumer Packaged Goods (CPG) market, which was valued at USD 2208.85 billion in 2023 and is projected to reach USD 3436.56 billion by 2034.

-

Modified Atmosphere Packaging (MAP) Market Trends - The global modified atmosphere packaging (MAP) market was valued at USD 19.52 billion in 2023 and is expected to reach USD 39.43 billion by 2034.

Regional Analysis:

Who is the Leader in the Non-Corrugated Boxes Market?

Asia Pacific dominated the market in 2024 due to its strong manufacturing base, expanding e-commerce sector, and rapid urbanization. Rising consumer demand for packaged goods and premium products drives large-scale packaging adoption. The region’s cost-effective production capabilities, availability of raw materials, and supportive government policies promoting sustainable packaging further strengthen its leadership. Additionally, countries like China, India, and Japan are witnessing increasing investments from major packaging players, who are expanding local operations to meet the region’s growing demand for eco-friendly and customized packaging solutions.

India Market Trends

India’s non-corrugated boxes market is driven by booming e-commerce, rising disposable incomes, and a growing organized retail sector. Local converters supply folding cartons and rigid boxes for pharmaceuticals, FMCG, and small electronics, while regional manufacturers focus on cost-effective, recyclable paperboard. Government emphasis on waste management and increasing consumer preference for attractive, gift-style packaging boost demand for premium printing and finishes. Challenges include fragmented supply chains and inconsistent quality, but rapid urbanization and rural market penetration sustain steady growth opportunities.

China Market Trends

China is leading the market through massive manufacturing scale, integrated supply chains, and strong export demand for packaged goods. Domestic brands and international buyers favor non-corrugated solutions for cosmetics, food, and electronics, supported by advanced printing, high automation, and efficient logistics. Government policies promoting green packaging and circularity accelerate the adoption of recycled and lightweight paperboard. Urbanization and digital retail platforms drive premium, custom packaging trends, while intense competition forces innovation in material science and cost optimization across the industry.

Japan Market Trends

Japan’s market is characterized by premiumization, meticulous design, and high-quality standards. Consumers expect refined aesthetics, functional convenience, and sustainable materials, prompting brands to use premium folding cartons and rigid boxes with sophisticated finishes. Manufacturers emphasize precision die-cutting, small-batch customization, and eco-friendly paperboard to meet strict recycling and waste-reduction norms. An aging population also influences packaging ergonomics and portion sizes. The market is mature and innovation-driven, focusing on differentiation through tactile packaging and superior unboxing experiences.

South Korea Market Trends

South Korea’s non-corrugated boxes market is heavily influenced by K-beauty and lifestyle brands that prioritize eye-catching, compact packaging. Fast product cycles, personalization, and limited-edition releases drive demand for high-quality printing, embossing, and specialty coatings. Tech adoption (smart labels, QR/NFC integration) and strong e-commerce logistics favor lightweight, visually appealing boxes optimized for shelf and online display. Sustainability is rising in importance, with brands and converters experimenting with recyclable paperboard and minimalist designs to reduce waste.

How is the Opportunistic Rise of the North America in the Non-Corrugated Boxes Market?

North America is the fastest-growing region in the market due to the strong expansion of e-commerce, premium retail packaging, and sustainability-focused initiatives. Rising consumer demand for eco-friendly and visually appealing packaging has prompted brands to adopt recyclable paperboard and advanced printing technologies. The U.S. and Canada are witnessing growing investments in lightweight, custom-designed packaging for food, cosmetics, and electronics. Additionally, technological advancements, digital printing, and increased preference for personalized, small-batch packaging further accelerate regional market growth.

U.S. Market Trends

The U.S. non-corrugated boxes market is expanding rapidly due to strong e-commerce activity, high consumer expectations for premium packaging, and sustainability regulations. Major industries such as food, cosmetics, and electronics increasingly prefer recyclable, lightweight folding cartons and rigid boxes for branding and logistics efficiency. Key manufacturers are investing in digital printing, smart labeling, and eco-friendly coatings to enhance design flexibility. Additionally, initiatives promoting circular packaging and corporate commitments to reduce plastic use are further driving market innovation and growth.

Canada Market Trends

Canada’s market growth is fuelled by sustainability-driven policies, rising online retail, and increased adoption of recyclable and biodegradable materials. The government’s single-use plastic bans have accelerated demand for paperboard packaging alternatives. Local manufacturers and converters are focusing on renewable fiber sources, clean inks, and compostable coatings to meet eco-conscious consumer preferences. Growth in premium food, beverage, and healthcare sectors enhances demand for customized, high-quality packaging solutions. Strategic partnerships and technological upgrades strengthen Canada’s competitive position in North America.

How Big is the Success of the Europe Non-Corrugated Boxes Market?

The European market is growing at a notable rate due to strong consumer demand for sustainable, high-quality packaging and stringent environmental regulations. Countries like Germany, France, and the UK are emphasizing eco-friendly solutions, promoting recyclable and biodegradable paperboard materials. The rise of e-commerce, premium retail products, and gifting culture further fuels demand for aesthetically appealing folding cartons and rigid boxes. Technological advancements in digital printing, smart labeling, and lightweighting enable manufacturers to create customized, visually attractive packaging. Additionally, growing investments by key players in local production facilities and innovation hubs support consistent market expansion across the region.

How Crucial is the Role of Latin America in the Non-Corrugated Boxes Market?

Latin America is growing at a considerable rate due to rising consumer demand for packaged goods, expanding e-commerce, and increasing urbanization. Countries like Brazil, Mexico, and Argentina are witnessing growing adoption of folding cartons and rigid boxes in food, beverages, cosmetics, and pharmaceuticals. The market benefits from cost-effective production, availability of raw materials, and an emerging focus on sustainable, recyclable packaging. Additionally, investments by regional and international players in modern manufacturing facilities and innovative designs drive market growth.

How Big is the Opportunity for the Growth of the Middle East and Africa Non-Corrugated Boxes Market?

The Middle East and Africa (MEA) present a significant growth opportunity for the non-corrugated boxes market. Rising urbanization, expanding retail and e-commerce sectors, and growing demand for premium, visually appealing packaging are key drivers. Countries such as the UAE, Saudi Arabia, South Africa, and Egypt are witnessing increased adoption of folding cartons and rigid boxes in food, cosmetics, and pharmaceuticals. The region’s focus on sustainable packaging, coupled with investments in modern manufacturing facilities and technology-driven production, further supports market expansion. Cost-effective local production and rising consumer awareness enhance the long-term growth potential in MEA.

Segment Outlook

Product Type Insights

The telescopic box segment dominated the non-corrugated boxes market in 2024 due to its versatile design, which allows for adjustable heights to accommodate various product sizes. The robust structure of these boxes ensures secure packaging for premium goods such as electronics, cosmetics, and luxury items, while maintaining aesthetic appeal. Telescopic boxes also support high-quality printing and finishing, enhancing brand visibility. The ease of assembly, reusability, and ability to reduce packaging waste further strengthen their preference among manufacturers and retailers, making them a widely adopted and dominant product type in the market.

The collapsible box segment is expected to grow at the fastest rate in the upcoming period. The popularity of this box is driven by space efficiency, easy storage, and transportation advantages, making it ideal for e-commerce, premium retail, and gift packaging. Collapsible boxes also offer flexibility in design, high-quality printing, and sustainable material use, catering to increasing consumer demand for eco-friendly and visually appealing packaging. Brands across cosmetics, food, electronics, and luxury goods prefer collapsible boxes for their convenience, cost-effectiveness, and ability to enhance unboxing experiences.

Thickness Insights

The thickness between 1.5mm to 2.5mm segment dominated the non-corrugated boxes market in 2024 due to its optimal balance of strength, durability, and lightweight design. This thickness provides sufficient structural integrity to protect products during storage and transit while keeping material usage and shipping costs low. It is ideal for premium goods, cosmetics, food, and electronics, as it allows high-quality printing and finishing for branding purposes. Its versatility, cost-effectiveness, and wide applicability across industries make this thickness range the most preferred choice among manufacturers and retailers.

The above 2.5 mm thickness segment is likely to grow at a significant rate in the market due to the increasing demand for premium, high-end, and luxury product packaging. Greater thickness provides enhanced strength, durability, and protection for delicate or heavy items, making it suitable for electronics, cosmetics, and gift packaging. It also allows advanced finishing techniques, embossing, and structural customization, enhancing brand appeal. As consumers increasingly value aesthetics and product safety, manufacturers are adopting thicker boards to meet these expectations, driving rapid growth in this segment.

End Use Insights

The consumer electronics segment dominated the non-corrugated boxes market in 2024 due to the sector’s need for durable, protective, and visually appealing packaging. Non-corrugated boxes, such as folding cartons and rigid boxes, provide robust protection for delicate devices like smartphones, headphones, and accessories during storage and transit.

Additionally, high-quality printing and finishing enhance brand visibility and consumer appeal, which is critical in a competitive market. The rise of e-commerce and premium product launches further drives demand for customized, secure, and aesthetically designed packaging in the electronics industry.

The food & beverages segment is expected to grow at the fastest CAGR in the upcoming period due to rising demand for convenient, safe, and attractive packaging. Non-corrugated boxes, including folding cartons and rigid boxes, offer excellent printability for branding, product information, and promotional designs, enhancing consumer appeal. Increasing e-commerce sales of packaged food, premium beverages, and ready-to-eat products drive the need for durable, protective, and sustainable packaging. Growing awareness of hygiene, portion control, and eco-friendly materials further accelerates the adoption of non-corrugated packaging in this sector.

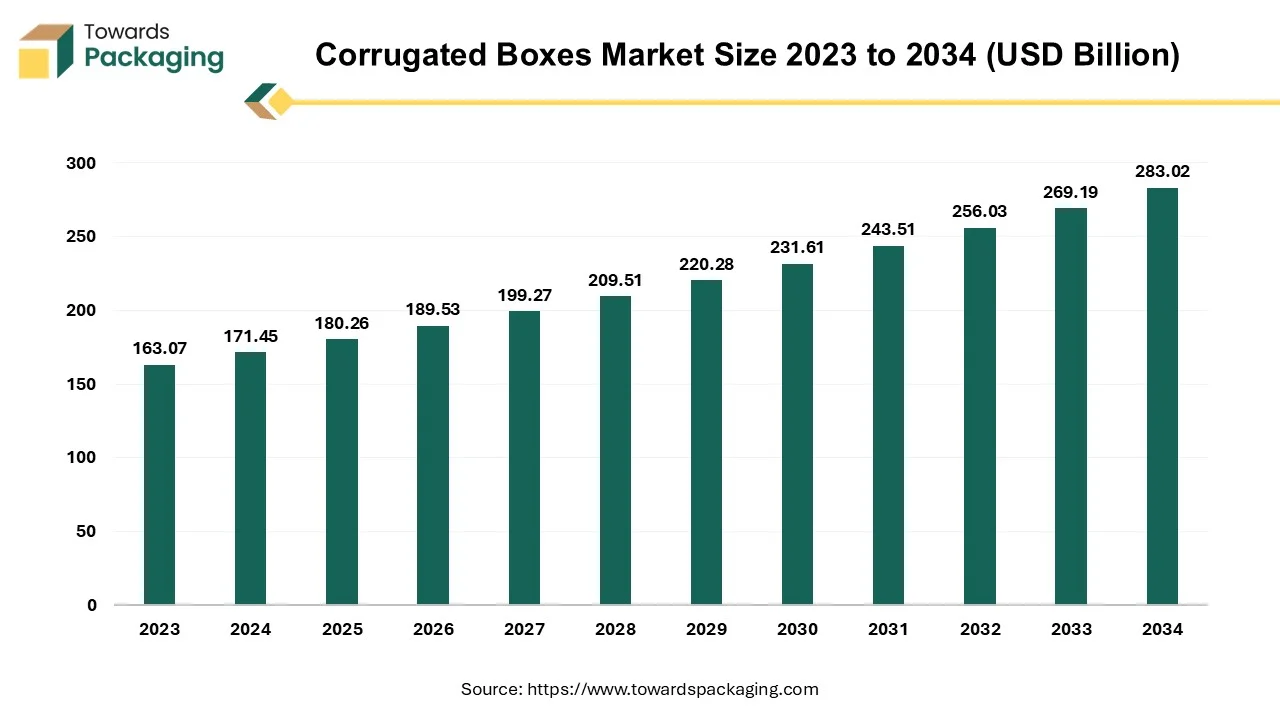

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

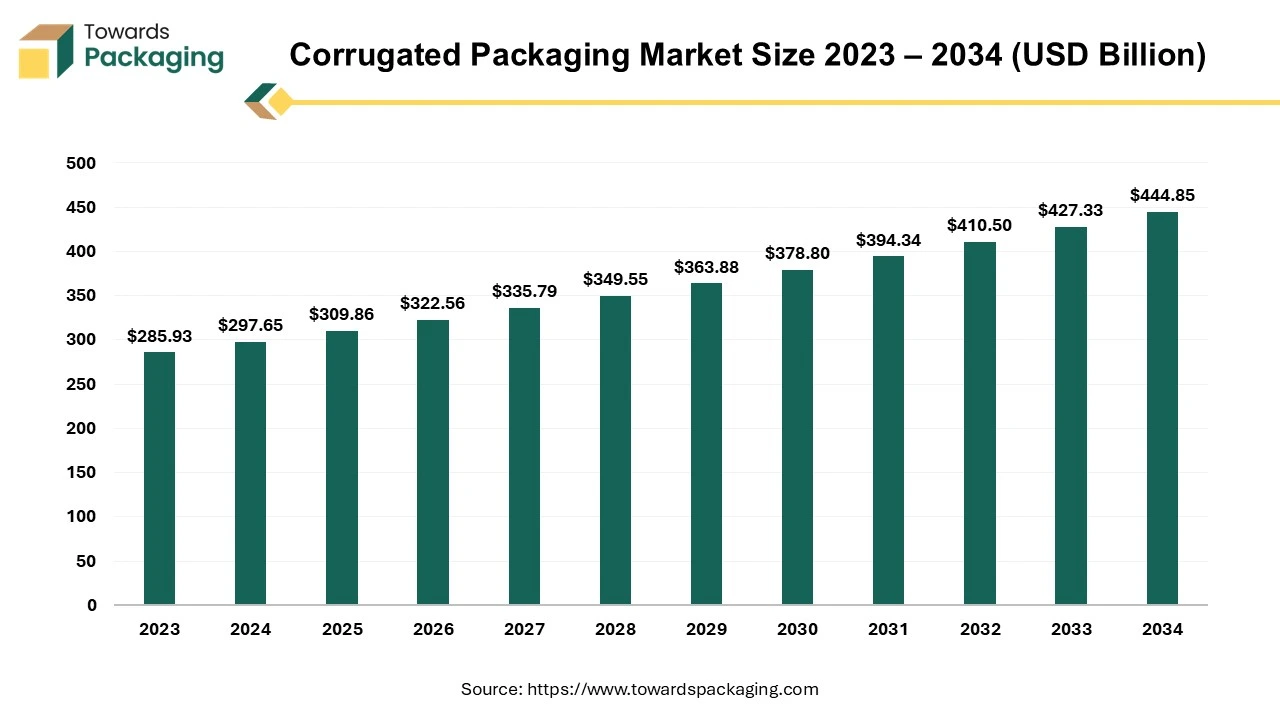

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

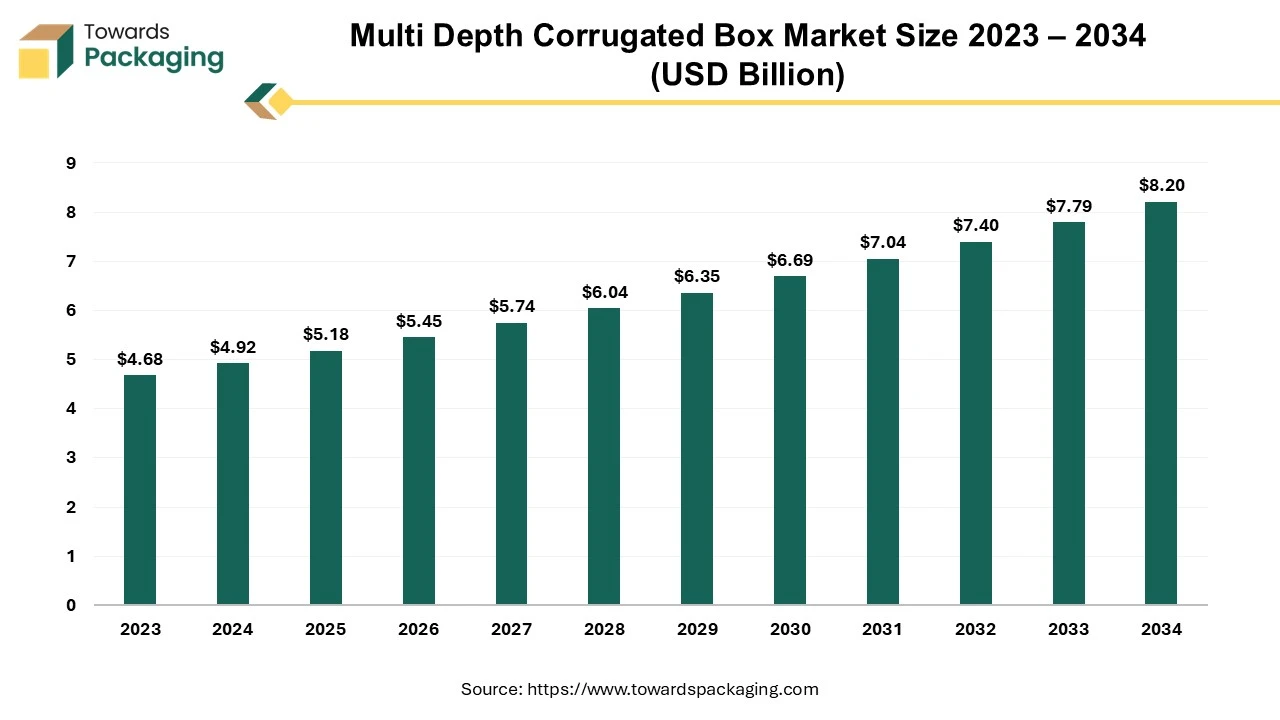

The multi depth corrugated box market is forecast to grow from USD 5.18 billion in 2025 to USD 8.20 billion by 2034, driven by a CAGR of 5.23% from 2025 to 2034.

Recent Development

- In June 2025, Coinciding with World Environment Day, ATP Lighting introduced new sustainable packaging made from untinted natural cardboard and printed with a single white ink. This initiative aims to minimize the environmental footprint of each product from production to delivery.

- On February 26, 2025, Harvest Group, unveiled a range of paper-based food containers, including sushi trays and deli containers, featuring custom printing options. These products cater to the foodservice industry, emphasizing sustainability and customization to meet diverse consumer preferences.

-

On October 28, 2024, Earthodic, secured $6 million in funding to develop a recyclable protective coating for paper and cardboard packaging, using lignin as a base material. This innovation aims to replace non-recyclable coatings, enhancing the sustainability of non-corrugated packaging materials.

Global Non-Corrugated Boxes Market Top Players

- Caraustar Industries Inc.

- DS Smith Plc

- Georgia-Pacific Corporation

- International Paper

- Klabin SA

- Clearwater Paper Corporation

- Graphic Packaging Holding Company

- WestRock

- Smurfit Kappa Group

- Emenac Packaging USA

- Deluxe Packaging, Inc.

- Mondi Group

- Stora Enso

- BioPak UK

- Creative Corrupack

Global Non-Corrugated Boxes Market Segments

By Product Type

- Hinged lid Box

- Telescopic Box

- Shoulder Neck Box

- Collapsible Box

- Others (Rigid Sleeve Box, etc.)

By Thickness

- Thickness up to 1.5 mm

- Thickness between 1.5mm to 2.5mm

- Thickness above 2.5mm

By End Use

- Food & Beverages

- Fashion Accessories & Apparel

- Cosmetic & Personal Health Care

- Consumer Electronics

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5230

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Towards Packaging, Your Trusted Research and Consulting Partner, Has Been Featured Across Influential Industry Portals - Explore the Coverage:

- Flexible Packaging Market - PACKNODE

- Is it finally safe to ditch your phone case? I put it to the test

- Battery Brands Charge Forward with Plastic-Free Packaging

- Why Non-corrugated Boxes Are the Future of Packaging

- Ampoules Packaging Market Size Expected to Reach $11.27 Bn by 2034

- Flexible plastic pouches projected to boom over the next decade

- GLOBAL PET FOOD PACKAGING MARKET SET TO DOUBLE BY 2032

- The Skinny on the Skin Packaging Market

- Healthcare Goes Green & Sterile

- The Different Types of Adhesives for Paper Packaging

-

Child-Resistant Packaging: Cannabis and So Much More

Towards Packaging Releases Its Latest Insight - Check It Out:

- Europe Food Packaging Market Drives at 4.55% CAGR (2025-34) - The Europe food packaging market is forecast to grow from USD 83.64 billion in 2025 to USD 124.83 billion by 2034, driven by a CAGR of 4.55% from 2025 to 2034.

- Release Liners Market Drives at 4.1% CAGR (2025-34) - The release liners market is projected to reach USD 28.17 billion by 2034, growing from USD 19.62 billion in 2025, at a CAGR of 4.1%.

- Returnable Transport Packaging Market Growth - The Returnable Transport Packaging (RTP) market is projected to grow from USD 10.59 billion in 2025 to USD 18.83 billion by 2034.

- Personal Care Packaging Market Drives at 6.3% CAGR (2025-34) - The personal care packaging market size is set to grow from USD 38.88 billion in 2025 to USD 68.71 billion by 2034, with an expected CAGR of 6.3%.

- Pharmaceutical Plastic Packaging Market Drives at 6.6% CAGR (2025-34) - The pharmaceutical plastic packaging market size is predicted to expand from USD 62.43 billion in 2025 to USD 110.97 billion by 2034.

- Protective Packaging Market Competitive Landscape - The protective packaging industry is projected to rise from USD 32.43 billion in 2024 to USD 50.84 billion by 2034, reflecting a CAGR of 4.6%.

- Rigid Plastic Packaging Market: Strategic Investment and Sustainability in a Growing Market - The rigid plastic packaging market is set to grow significantly from USD 351.69 billion in 2025 to USD 614.65 billion by 2034.

- Pharmaceutical Packaging Market Drives at 10.7% CAGR (2025-34) - The global pharmaceutical packaging market is forecasted to expand from USD 159.31 billion in 2025 to USD 397.71 billion by 2034.

- U.S. Beverage Packaging Market Competitive and Value Chain Analysis - The U.S. beverage packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Recyclable Plastic Market Drives at 8.89% CAGR (2025-34) - The recyclable plastic market is forecast to grow from USD 91.03 billion in 2025 to USD 195.92 billion by 2034, driven by a CAGR of 8.89% from 2025 to 2034.

- North America Packaging Market Drives at 4.33% CAGR (2025-34) - The North America packaging market is forecasted to expand from USD 333.86 billion in 2025 to USD 488.92 billion by 2034.

- Industrial Packaging Recycling Services Market Drives at 4.53% CAGR (2025-34) - The industrial packaging recycling services market is expected to increase from USD 67.76 billion in 2025 to USD 100.65 billion by 2034.

- Folding Cartons Market Outlook Scenario Planning & Strategic Insights for 2034 - The global folding cartons market is estimated to reach USD 307.92 billion by 2034, up from USD 178.52 billion in 2024.

- Eco-friendly Packaging Market Drives at 7.6% CAGR (2025-34) - The eco-friendly packaging market is forecast to grow from USD 257.73 billion in 2025 to USD 498.29 billion by 2034.

-

Clear Plastic Film Market Size and Competitive Landscape - 2034 - The global clear plastic film market is set for substantial growth, with forecasts projecting revenue expansion into the hundreds of millions between 2025 and 2034.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.